Get the free 11710 a form - ginniemae

Show details

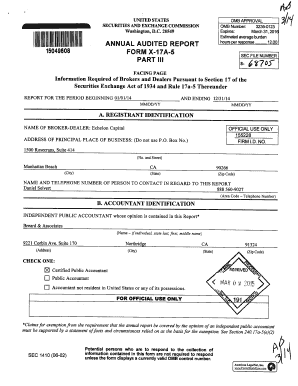

Issuer's Monthly Accounting Report U.S. Department of Housing and Urban Development Government National Mortgage Association OMB Approval No. 2503-0033 (Exp. 12/31/2013) Public reporting burden for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 11710 a form

Edit your 11710 a form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 11710 a form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 11710 a form online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 11710 a form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 11710 a form

How to fill out 11710 a form:

01

Start by obtaining a copy of the 11710 a form from the appropriate source.

02

Carefully read the instructions provided with the form to familiarize yourself with its requirements.

03

Begin filling out the form by entering your personal information such as your full name, address, and contact details.

04

Provide any relevant identification numbers or codes as requested on the form.

05

Follow the specific instructions for each section of the form, ensuring that you provide accurate and up-to-date information.

06

Double-check all entries for accuracy and completion before submitting the form.

07

If needed, attach any supporting documents or signatures as required by the form's instructions.

08

Once the form is fully completed, submit it to the designated recipient or authority as indicated on the form or in the instructions.

Who needs 11710 a form:

01

The 11710 a form may be required by individuals or entities involved in a specific application process.

02

It is typically needed by individuals seeking a certain type of license, permit, or authorization.

03

The form may also be required by organizations or businesses initiating a particular procedure or application.

04

The specific details regarding who needs the 11710 a form will be mentioned in the form's instructions or the relevant regulations governing the process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out 11710 a form?

Form 11710, also known as the Application for Sales and Use Tax Permit, is a form used to apply for a permit to collect and remit sales and use taxes in the state of California. Here's how you can fill out this form:

1. Download the form: You can download form 11710 from the California Department of Tax and Fee Administration (CDTFA) website. Alternatively, you can request a copy of the form by calling their office or visiting a local CDTFA office.

2. Identification section: Start by providing your individual or business information in the identification section. This includes your name or business name, address, contact details, and other necessary identification information.

3. Ownership information: If your business is a partnership, corporation, or LLC, provide the ownership details requested in this section. This includes the names and addresses of any partners, corporate officers, LLC managers, or members. If your business is a sole proprietorship, you can skip this section.

4. Business information: Fill in the required information about your business, including the type of business (e.g., retail, wholesale), the date you started or acquired the business, and the type of goods or services you offer.

5. Sales and use tax information: Answer the questions about your expected sales and use tax liability, including estimated taxable sales and purchases for the first 12 months. If you anticipate that your sales will not exceed $1,000 in the first year, you can indicate it on the form.

6. Other tax obligations: In this section, you'll need to identify if you have any existing state tax permits, such as an employer identification number (EIN), seller's permit, or any other relevant permits required by the CDTFA.

7. Sign and date: Review your completed form for accuracy and sign and date it to attest that the information provided is true and correct.

8. Submit the form: Make a copy of the completed form for your records and submit the original to the CDTFA. You can mail it to the address provided on the form or hand-deliver it to a local CDTFA office.

Note: It is important to make sure all information is accurate and complete when filling out the form. If you have any questions or need assistance, you may contact the California Department of Tax and Fee Administration.

What is the purpose of 11710 a form?

Form 11710, also known as the "Request for Verification of Birth," is a document used by the United States Citizenship and Immigration Services (USCIS) to verify the authenticity of a birth certificate issued by a foreign country. The purpose of this form is to request verification of the birth certificate presented by an individual who is applying for immigration benefits in the United States. The USCIS requires this verification to ensure the accuracy and legitimacy of the submitted birth certificate.

What information must be reported on 11710 a form?

Form 11710 is a report form used by a financial institution to notify the Financial Crimes Enforcement Network (FinCEN) of suspicious transactions or activities related to money laundering or suspected terrorist financing. The information that must be reported on the form includes:

1. Financial institution information: Name, address, and contact details of the reporting institution.

2. Filing institution information: Name, address, and contact details of the institution that is filing the report (this may be different from the financial institution).

3. Subject information: Name, address, social security number (or taxpayer identification number), and date of birth of the individual or business involved in the suspicious activity.

4. Date and type of suspicious activity: Detailed description of the suspicious transaction or activity, including the involved accounts, dates, amounts, and transaction details.

5. Law enforcement contact information: Details of any law enforcement agency that has been contacted regarding the suspicious activity.

6. Relevant supporting documentation: Copies of related documents such as transaction records, wire transfer details, account statements, and any other evidence that supports the suspicion.

7. Reporting institution's action: Details of any actions taken by the reporting institution in response to the suspicious activity, such as freezing the accounts or terminating the relationship with the subject.

8. Additional remarks: Any additional relevant information or comments regarding the suspicious activity.

It is important to note that financial institutions are required to file Form 11710 with FinCEN within a certain timeframe after becoming aware of the suspicious activity. The specific reporting requirements may vary based on applicable laws and regulations.

How can I edit 11710 a form on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing 11710 a form right away.

Can I edit 11710 a form on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign 11710 a form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete 11710 a form on an Android device?

Use the pdfFiller mobile app to complete your 11710 a form on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your 11710 a form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

11710 A Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.